CHOOSE AMONG THESE PAYMENT OPTIONS:

One Time Payment of $577 for a 3-month program

One Time Payment of $1,054 for a 6-month program

Monthly Payment of $199 for a 3-month program

Monthly Payment of $179 for a 6-month program

By the end of this program, you'll have...

- Created a Realistic and Sustainable Budget

One that meets your needs, and doesn’t take away your favorite things, but also keeps you on track for your goals. - Made Peace with Your Money Past and Tackled Your Mindset

Tackling your past, and creating awareness in the present will help you get to the future results that you desire. - Clear Goals and Milestone Steps to Achieve Them

You will have the roadmap to not only crush goals in this 90 day period, but the system for goal crushing for a lifetime. - Proven Strategies to Stay on Track with Your Plan

It’s one thing to start a plan, it’s a whole other thing to stay ON a plan. This program will teach you the skills to stick with your new money management skills for a lifetime. - Tools to Support Your Goals

Let’s make it as easy as possible for you to get to your goals with the right mix of tech and tools to meet your preferences. - Accountability Habits to Maintain Your Success

I’m not your mother…thank goodness. But I will both hold you accountable and help you transition that accountability back to yourself to maintain your progress.

What’s Inside “Your Money, Your Goals”?

Module 1 : Dreams: Past, Present & Future 💭

In order to make true progress, we need to get clear on not only where you’ve been but also where you want to go.

One of my favorite movie is The Notebook. Anyone else? You know that part where Noah asks Allie what she wants… “What do you want?!” Allie replies, “It’s not that simple.” You’ll be answering that question with certainty, straight away.

We’ll be tapping into your dreams, fears, and mindset before clarifying what it is you really want.

Module 1 Highlights:

- Get clear on where your mindset sits with money, and make tangible shifts towards your goal mindset.

- Make peace with your money story to date. You’ll hold onto the habits that served you, and let go of those that didn’t.

- You’re going to identify the fears, triggers, and symptoms that lead to less than ideal money choices – and make a plan to address them.

- Reflection will be key to getting unstuck and making progress on your money story.

- Goal setting and dreaming will be the motivation to get you moving forward, with clear goals for the next 90 days and the rest of the year.

⬇️ Check out the highlights of the remaining modules 2 – 9 below ⬇️

It’s time to prep for change, both logically and emotionally. In order to get different results than you’ve been getting, you need to change your approach – I think Einstein said some version of this. Change is inevitable, but that doesn’t make it easy.

You’re going to prepare for some changes both through education (head) and emotion (heart). Again, to make sustainable and long lasting results – this foundational work from these first two modules is critical.

Module 2 Highlights:

Let’s get some key jargon, terms and lingo out of the way – no more excuses for not knowing about this money stuff.

- Your Money, Your Goals – and YOUR priorities. Your goals will be based on your priorities, and you’ll get clear on those values-based priorities in this module.

- We will address the elephant in the room by way of contentment and fear of missing out.

- Fun-ish. You’ll be creating new habits and we’re going to gamify the process a bit. It’s not exactly Monopoly, but it also doesn’t have to be a trip to the dentist chair either.

The budget, is the plan that makes our takes your big financial goals and breaks them into monthly achievable milestones and gives you a plan for your money – not just an overarching plan, but a practical and tactical weekly action plan.

Module 4 Highlights:

- You’ll create a personalized budget based on your needs, specific circumstances, and variables.

- Planning ahead strategies for irregular income that doesn’t fit a traditional pay cycle to avoid surprises and have more control over your money.

Increasing income tactics that will cover both your short and long game, based on your goals.

And of course, decreasing expense considerations that still keep your favorite items, but skip out on any added bills that don’t serve you this season.

You need the right tools in your tool belt that fit you best to succeed in the long term. This module provides you with options to pick and choose from.

Module 6 Highlights:

- Get access to my favorite calculators; both simple for easy math and tracking, as well as more complex financial planning and awareness.

- You’re going to want to track your progress in a variety of ways, and you’ll find the right ones for your needs.

- As your money management skills grow you’ll want to try on different types of budgeting tools to meet your needs best – you’ll have a great variety to choose from.

You will understand the value of celebrating, reflecting, and continuing on the journey ahead.

Module 8 Highlights:

- Individualized celebration plan that fits – you guessed it, your money and your goals.

- Reflection surrounding your growth and progress with a clear before and after.

- Brand new set of goals for the next season.

Let’s be honest, the first two modules have some heavy mental lifting. This module has less emotional weight, and more numbers prep readiness.

Think of this as is you were creating an incredible meal or dessert on a Food Network show. You know how they have all of the ingredients out in their cute little bowls This module – is that…for your finances.

You will have a full picture of your finances all laid out in front of you when we wrap this week and be ready to create your budget.

Module 3 Highlights:

- Get a true picture of your expenses, not just bills but discretionary spending. periodic expenses, savings goals and more figured out.

- Streamline, update, and adjust a few areas to make budgeting life easier on yourself.

This program is not just to support your money management now, but for a lifetime.

Insert supporting strategies that will make managing your money, and your goals sustainable and long lasting to build the life that you want.

Module 5 Highlights:

- Personalized emergency fund tools that will help support you when the inevitable happens.

- You’ll incorporate savings strategies for both short and long -term goals that also give you more ‘permission to spend’.

- Tools for creating boundaries, pauses, and limits to your spending categories that tend to go a little overboard at times.

- Food has its own dedicated lesson! We all eat, and this expense category has dedicated lessons to support your spending.

- Protecting your money, your goals, and your family through an educational insurance run-down and protection plan.

- You’ll determine how giving back in some capacity fits into your overall planning.

- You will identify your ideal rhythm and cadence for managing your money, and find the right process for reconciling the reality versus the plan.

This program is not a magic pill or easy button that removes challenges from your path, you will still encounter obstacles with your money management!

Flex and grace within this process are skills to be learned.

Module 7 Highlights:

- Coming away with a balanced and sustainable approach that works for you.

- Strategies to get back ‘on the wagon’ when your wagon takes a tumble.

Our final module will leave you proud of your progress and and planning for the future that you were called to lead.

Module 9 Highlights:

- Sharing your wins, your story, and walking away with some pep in your step!

When you enroll, you'll get:

YOUR MONEY, YOUR GOALS

90 days of Finance FUN-damentals

(A $2,497 value)

9 Action-Packed Modules over 12 to 24 Weeks

All of the teaching, tools, strategy and support in action packed video instruction, sent out to you in bite size pieces week by week to be confident with your money management that matches Your Money, and Your Goals!

Personalized Budget and Plan

A realistic, sustainable approach that matches your needs – tailored to you.

One-on-One Coaching Calls

Get two one-on-one coaching calls with your coach each month that you’re in the program.

Strategies, Methods, and Tools

ALL of the supporting tactics that are shared with private coaching clients are available to you to pick and choose what works best for you guessed it… Your Money, and Your Goals.

START TODAY! 'YOUR MONEY, YOUR GOALS'

One Time Payment of $577 for a 3-month

program

One Time Payment of $1,054 for a 6-month program

Monthly Payment of $199 for a 3-month program

Monthly Payment of $179 for a 6-month program

Frequently Asked Questions

A budget is simply a plan for your money, and they come in all kinds of shapes and sizes.

We will find the right plan for your money. Don’t be intimidated by the word ‘budget’ I believe that you’ll come to love or at least like very much…the entire budgeting process.

Feels a little ironic, I get it.

But here’s the deal – what is it costing you to NOT figure this out month after month, and year after year?

We’re going to put a stop to the crazy cycle and you’re going to figure this out once and for all.

It’s an investment in your future that will pay off over and over.

I’ve got you covered. Not only will you have the opportunity to get your specific questions answered with your coach or group coaching calls, but you’ll also have the chance to submit your budget for feedback and audit. Together, we are going to make this happen!

Yes, you absolutely can – it’s just a little lonely. I wish I had the support of a course and a coach when I started my money management journey; I’m certain I would have gotten faster results just as my clients have.

If this work is important enough to you, you’ll find a way to commit to roughly 1 hour of instruction and another hour or so of homework weekly. What is that one Saturday morning a week, or 20ish minutes each day? Yes – you can find the time if you’re really wanting to make a change.

You have 30 days, which includes four total modules to be firm in your decision.

I’m so confident that you’ll already see so much growth in your progress anil be well on your way to being a budget boss that you won’t think twice about requesting a refund.

All the things! The video course complete with 9 modules and countless resources and guides to complement the teachings. The group coaching calls, twice a month coaching calls one-on-one with your coach. The suite of teachings from other experts.

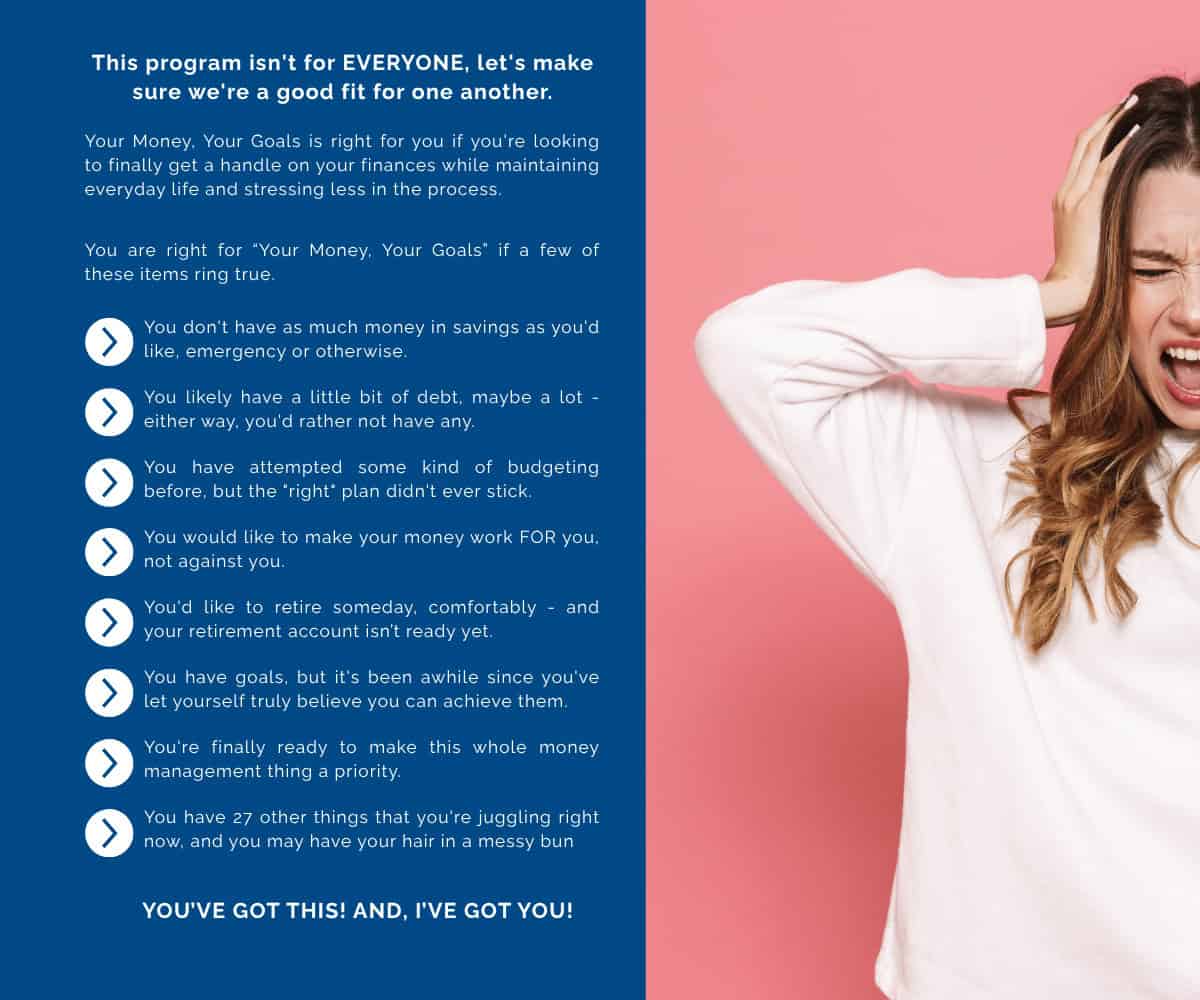

If you're thinking this sounds great, but I'm still not 100% sure, keep reading...

You should give Your Money, Your Goals a 30 day risk-free shot if any of the following are ringing true for you today.

😫😫😫

You’re afraid of what could happen if you don’t get a handle on your money management. The reality of that worst case scenario coming true is closer than you want to admit, and if you’re being honest it wakes you up at night.

You are so done with living paycheck to paycheck and feeling like you’re never getting ahead. Over. It. You’re motivated to put in the work and figure this out once and for all.

🤩🤩🤩

You’re just getting started on your money journey, and you want to do it right the first time, saving yourself years of stress and frustration, not to mention money. Let’s do it, and do it right!

Do we all wish that we had this money stuff figured out years ago? Yes, yes we do. 🙋🏼♀️

But there’s no sense in beating ourselves up about that now. Now is the time to take action. You have a coach and guide that has been where you are that will walk you through the process of taking control of Your Money and Your Goals, once and for all.

When my husband and I finally figured out our money situation and started the process of better money management back in 2013, I wanted EVERYONE to understand the peace and control that shifted for our family.

Eventually, that love of the process led me to become a Master Trained Financial Coach through Ramsey Solutions, and become a Ramsey Preferred Coach, launching my coaching business in January 2020. Ive helped over 100 individuals and couples get their financial ducks in a row and see the visible shift in not only their money goals, but their spirit.

I want that for you, too! If you have longed to stress a little less and be more intentional with your money, then ‘Your Money, Your Goals’ is for you.

What do you have to lose? You have a risk-free 30-day money-back guarantee. What do you have to gain?

- Hope

- Confidence

- Strategy

- Plan

- Support

- Purpose

Join me to tackle Your Money, and Your Goals. You are going to remember this year as the one where you figured out your money management once and for all.

See you soon!

Get to know more about the coaches here.

START TODAY! 'YOUR MONEY, YOUR GOALS'

One Time Payment of $577 for a 3-month program

One Time Payment of $1,054 for a 6-month program

Monthly Payment of $199 for a 3-month program

Monthly Payment of $179 for a 6-month program

Still have questions?

Book a call to chat further.